North Carolina’s Get-Out-the-Conservative-Vote Constitutional Amendments

The North Carolina General Assembly has passed bills to place six constitutional amendments on the ballot on November 6th. A simple majority vote puts these ill-advised amendments into the state Constitution.

The purpose of these amendments is to get right-leaning voters to the polls for the crucial mid-term elections. Take Senate Bill 677, a Constitutional amendment to protect the right to "hunt, fish, and harvest wildlife". Is there some threat to these activities? Nope. But it sure sounds like something that the GOP's base would want to come out to the polls to support.

Other than cluttering up the Constitution, SB 677 sounds harmless, although maybe there's something nefarious about it that I don't understand. But some of the other amendments are terrible for the future of North Carolina. I'm going to analyze one of them, a cap on state income tax rates, in the rest of this post.

State Income Tax Cap Constitutional Amendment

Senate Bill 75 caps the state income tax at 7% of net incomes. This replaces the Constitution’s current cap of 10%.

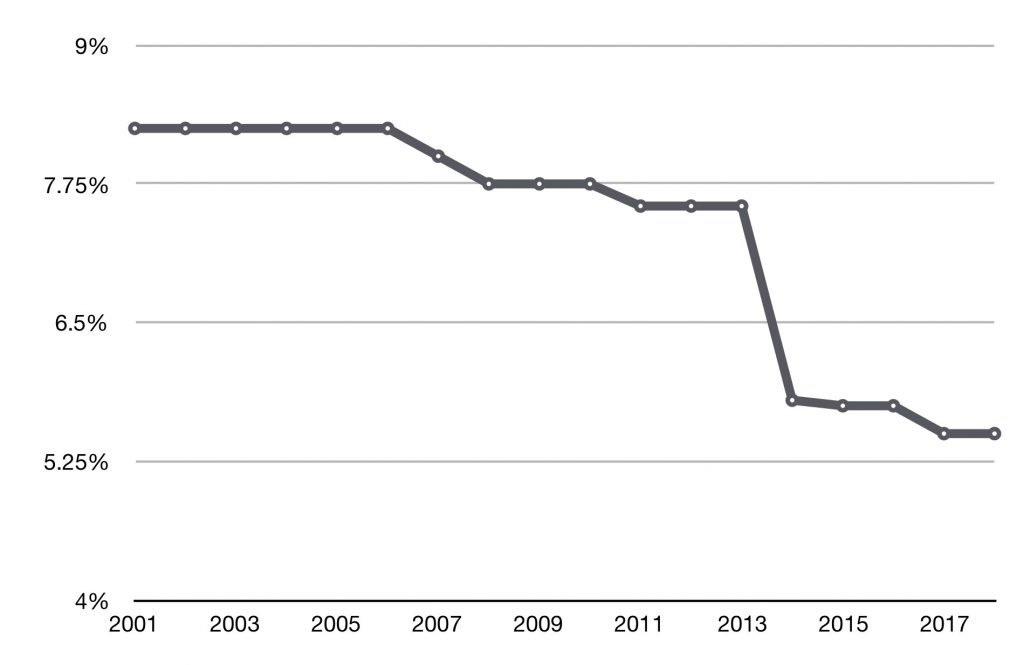

The recent history of NC’s income tax rates, which is available from the NC Department of Revenue here, is necessary context for understanding SB 75. Here are the top marginal tax rates since 2001:

As I’ve explained previously, this percentage is the percentage of the next dollar earned paid by top earners. Until 2014, lower-earning taxpayers had a lower marginal tax rate, but NC switched to a flat-rate tax in 2014, meaning that everyone, regardless of earnings, pays the same marginal rate. This switch lowered the marginal rate for all taxpayers, with married couples earning over $100,000 getting the largest reduction (1.95%) and lower-earners getting the smallest reduction (.2%). This was a big gift to our highest-earning taxpayers.

SB 75 was filed in February 2017, proposing an amendment to cap the tax rate at 5.5%, a hair above the current income tax rate. The Senate passed this bill in March 2017, but the House failed to approve it then. The House reconsidered it in June 2018, replacing the 5.5% cap with a 7% cap and passing the bill on June 28th. The Senate passed the revised bill the same day, placing the 7% cap in front of voters.

The original SB 75 would have locked in the entire big gift to high earners incorporated into the tax code in 2014 and would have prevented any increases in overall tax rates. The revised version is less onerous in that it locks in only a portion of the gift to high earners and is not quite as tight a constraint on tax rates.

Nevertheless, SB 75 is a bad idea.

Why is This Cap Bad?

SB 75 is bad both because income tax caps are generally bad policy and because of the specific features of this particular income tax cap.

Income tax caps are bad policy because a state’s revenue needs can vary unpredictably over time and income tax caps eliminate flexibility. If income taxes can’t be raised to meet needs, a state's primary alternative is to raise sales taxes (and various usage fees).

Sales taxes (and usage fees) impact poor people much more than they impact wealthy people: Poor people must spend most of their income, subjecting most of their income to sales tax; wealthier people spend a much lower percentage of their income, so sales tax consumes a much smaller percentage of their income. In other words, sales taxes are regressive.

Moreover, the specific cap passed in SB 75 locks in rates that are lower than recent historical rates and the new flat-rate tax structure shifts more of the income tax burden to lower earners. We have no experience in NC with such low rates and such shifting of tax obligations.

Experience in other states, like Kansas, that have lowered tax rates dramatically is poor. We are already seeing hints of the impact in NC with a precipitous drop in inflation-adjusted per student spending in public schools.

Foolish to Experiment in Constitutional Amendments

It is one thing to try an experiment, however ill-advised, but something entirely different to enshrine an experiment in the state’s Constitution. A Constitutional income tax cap below historical rates ties our future legislators’ hands. If they need to address the state's future needs, they won’t be able to do so by returning even to historical levels of income tax; their only recourse will be to raise sales taxes, which will hurt poor people more than wealthy people.

This is foolish. Unfortunately, it is also consistent with the NC GOP’s trend to both reduce spending on public services and to shift the burden of taxes away from their wealthier constituents.